Consideration of Driver Behavior in Traffic Simulation

February 26, 2021

Tunnel Construction Designs

February 27, 2021Introduction.

The financial crisis began with the turn of the real estate market in 2007 in the United States has far reaching ripple effects not just within the States but throughout the world. Through the crisis, various weakness of the monetary and financial systems began to surface. A main trigger of the financial crisis was the securitization, a financial instrument used by banks, which inherently allows them to load off risky loans to other companies. Where this money making scheme began in the Wall Street, soon every other bank around wanted get in on the soaring profits and expanded way beyond their own particular area of expertise. It is inherently ironic, that an instrument that was used to reduce risk by the banks, invariably backfired result in their downfall.

This brought the International Monetary Fund (IMF) in a debacle, since it has been the central international organization is therefore responsible for the oversight in the monetary system (Hammond, 2011). However, where it is not practicable for IMF to lend money to all the developed countries, this was an opportunity for IMF to reassert its role as the global macroeconomic policy coordinator through playing a positive role with the under developed nation, which invariably is twofold: firstly, it involves dealing with crisis immediately and second, a systematic reform of the monetary system which will have long term benefits.

As a result of various forms of criticism aimed at IMF regarding their loan policy to countries, multiple countries have developed foreign reserve positions so that they do not have to return IMF for help in case there was another global crisis on the wake (Svensson, 2012).

Taylor’s Rule.

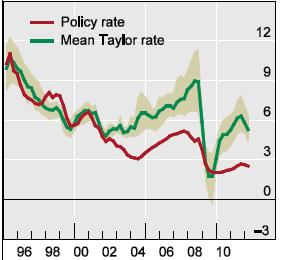

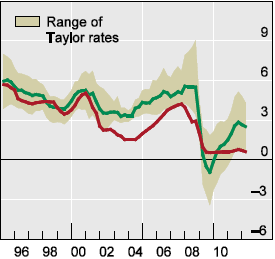

Gambacrota et al, 2012 define the Taylor rule as a simple monetary policy which links together the policy rate levels with that of inflation deviations from the target potential output which is inherently the output gap. Where it was initially used as an illustration of desirable policy by the United States, however, not long after that it began to be used as a popular tool for assessment of monetary policy not only within advanced economies but also within the emerging market economies. The Taylor rule has been used as a yardstick during the great inflation period in the 1970s, the moderation period in the mid 1980’s then a period of low macroeconomic volatility and low inflation. Throughout these periods, the policy rates and have broadly consistent with the application of the Taylor rule (Woodford, 2001). According to Taylor, 2007, during the recent global economic crisis, the policy rates predicted by the Tyler rule lower in various advanced economies, which is another factor that has been identified as the basis of imbalance in the monetary policy (Taylor, 2009). Taylor, 2012 states that this deviation reflects a further change in the global monetary policy however, Bernake has already shunned this analogy in his previous writing in 2010.

The application of Taylor’s Rule and effect on monetary policy globally.

Looking at the numerical form, the rule is written down as: i = r * +π * +1.5 (π −π *) + 0.5 y, where i stand for the nominal policy rate, r* is represented as the long run, π * is represented as the inflation rate posed by central bank, π is the inflation rate at the current period and y is the output gap in the current period (Svensson, 2012).

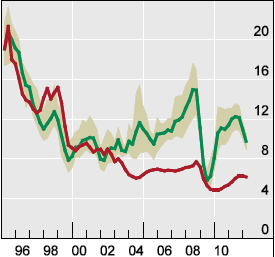

The rule inherently applies that stabilization of inflation is done by the central banks through inherent output and target levels around its particular potential target. Positive deviation, which implies negativity inherently from two stated variables would subsequently lead to loosening the monetary policy the figures below illustrate the application of the Taylor’s rule and the policy rates globally, in advanced economies and in emerging market economies.

Figure 1: Application of Taylor rule to global policy rates (Taken from Hofman and Bogdanova, 2012).

Figure 2: Application of Taylor Rule to advanced economies (Taken from Hofman and Bogdanova, 2012).

Figure 3: Application of Taylor Rule to emerging market economies (Taken from Hofman and Bogdanova, 2012).

The assignment highlights through the application of practicable monetary models and rules an application and distinct use of both the flexible approach and the discretionary approach. The essay begin with definition of inflation targeting then goes into a discussion regarding the discretion versus flexibility approach which is a continuation of the introduction on Taylor’s rule which inherently is amalgamated with various further rules applied (Bernanke, 2010). The essay then goes on give a concluding paragraph while highlighting the benefit of either of the approaches: flexibility and discretion in light of the current global monetary crisis.

Inflation targeting.

Inflation targeting has become a popular economic policy that has allowed the central bank to actyally give a preduetc target of inflation and then following the prediction makes efforts to ensure that the real inflation rate comes up or goes down to the predicted target inflation. (Hammond, 2011). The relationship observed between inflation and interest is known to be inverse; therefore, where the inflation rates is subsequently higher than the predicted amount, the banks will most likely increase the rate of current interest, subsequently where the interest rates are lowered the inflation is also seen to drop as well. This approach or monetary tool is seen by many to be as an economic stabilizing agent. The global financial crisis highlighted amongst other things that any one internal factor was not a reason attributed towards the crisis and whereby without considering the global situation if countries play around with the interest rates then they will be at a disadvantage (Hannoun, 2012).

Discretion versus flexibility.

There has been sufficient emphasis on the use of policy rules within the recent macroeconomic research especially before the global financial crisis. This section analyses various forms of discretionary and fixed monetary policy rules following which their benefits and consequential acceptance will be illustrated.

In comparison to the discretionary policy, the Fixed monetary policy rule has been designed in terms of a target policy achieving goal that has been set by the government, and then therefore is followed invariably without justification. It constituents the various monetary policy tools that have been seen to be applicable throughout the crisis globally. Taylor’s Rule is one such example which has been discussed in the section above. Another popular monetary policy rule, following the application of Taylor Rule is the Friedman Rule which requires the interest rate to be set at zero. It requires a balance to be maintained between the social and the opportunity cost thereby, both must be equal in terms of fiat money. This simply means that the central bank is aiming at deflation which is subsequently at the same standing as interest rates which can be compared through safe assets. The application of this Rule is seen to be a welfare maximising policy in various models of the economy, and has been pointed out by Hannoun, 2012, that in order to achieve optimum results interest rate can be increased or decreased from zero accordingly. The same optimal results can be invariably achieved by the eliminating the interest rates between the nominal policy interest and the interest on subsequent revenues to ensure that the rates achieved are actually equal at all times.

Conclusion.

Macro prudential policy adoption has been advocated by the G20 leaders as well as the financial stability board. Haldane, 1995, states that there is a need to statistically and systematically analyze any shortcoming that is a consequence of the macro factors which aims at the production of a pro cyclical approach which as pointed out by Gambacrota et al, 2012, will support sustainable growth.

Where it may be practicable to use a discretionary policy post financial crisis, a primary reason being that the application of fixed rules did not bring about the desired result but in fact was a constituent of the failing monetary policy, however, keeping in mind the trade off between ex ante efficiency of the discretionary policies, the ex post efficiency of the fixed rules, a hybrid monetary policy which constrains discretion has been adopted in the monetary policy mechanisms (Merrouche and Niar, 2010). The central bank in response to any potential pitfalls of the discretionary monetary policy has chosen the public reaction function approach which is not only clearly stated but ensures transparency and accountability of the decision making process.

This clearly indicates the preferences of the central bank and monetary institutions in using these mechanisms primarily through a hybrid strategy which inherently seems practicable in the face of such a crisis, but whose only success can be judged by the use application of the same policy in long term.

References.

Bernanke, B. (2010), “Monetary policy and the housing bubble”, speech given at the American Economic Association Annual Meeting, Atlanta, Georgia, 3 January.

Gambacorta, L, Hofmann, B and Peersman, G. (2012), “The effectiveness of unconventional monetary policy at the zero lower bound: a cross-country analysis”, BIS Working Papers, no 384.

Haldane, A. (1995), “Inflation Targets”, Bank of England Quarterly Bulletin, (August) 250-9.

Hammond, G. (2011), “State of the Art of Inflation Targeting,” Centre for Central Banking Studies Handbook No. 29, (London: Bank of England).

Hannoun, H. (2012), “Monetary policy in the crisis: testing the limits of monetary policy”, speech given at the 47th SEACEN Governors’ Meeting, Seoul, 14 February.

Hofmann, B. And Bogdanova, B. (2012), Taylor Rules and Monetary Policy: a global great deviation. BIS Quarterly Review.

Merrouche, O and Nier, E. (2010), “What caused the global financial crisis? Evidence on the drivers of financial imbalances 1999–2007”, IMF Working Paper, no WP/10/265, December.

Svensson, L. (2012), “The possible unemployment costs of average inflation below a credible target”, Sveriges Riksbank, mimeo.

Taylor, B. (2009, 2012), The Financial Crisis and the Policy Responses: An Empirical Analysis of what went Wrong, Working Paper 14631.

Available: http://www.nber.org/papers/w14631, accessed 12 November, 2013

Woodford, M. (2001), “The Taylor rule and optimal monetary policy”, American Economic Review, no 91(2), pp.232–37.

Get 3+ Free Dissertation Topics within 24 hours?