Managerial Economics

December 24, 2020

The practice of leadership in Organizations

December 24, 2020International business pirouettes are a kaleidoscope of cross-cultural negotiations and economic pas de deux in the global commerce ballet. Each market entry is a unique arabesque, crafting a mosaic of interconnected strategies that transcend borders, resonating with the universal rhythm of opportunity in the international business grand performance.

In our increasingly interconnected world, international business has become a cornerstone of the global economy. As countries open their doors to foreign trade and technology continues to shrink the geographical divide, companies find themselves operating in a dynamic and competitive international marketplace. This blog will explore the multifaceted world of international business, its significance, challenges, and opportunities.

Learn More About International Business

Explore More About International Business

International business is more than just a business strategy; it is a fundamental force shaping the global economy. As companies expand their horizons and explore new markets, the world becomes more interconnected. Embracing the opportunities and addressing the challenges of international business is crucial for companies seeking sustained growth and success in this dynamic and competitive global marketplace.

Question 1- Using Supply and Demand Analysis, Identify Which You Believe To Be The Main Factors In Determining The Price of Gold?

Supply and demand analysis holds considerable influence when deciphering the economic implications of essential commodities. This analytical framework operates on the premise that all other variables remain constant, allowing us to discern realistic economic trends. Gold, a cornerstone of commodity markets, has historically stood as a barometer for economic shifts and price oscillations driven by many micro and macroeconomic influences. Asset pricing and stock valuations are intricately linked to specific supply and demand patterns and financial indicators (Parkin et al., 2015). Yet, in the context of gold, a prevailing viewpoint among researchers suggests that price fluctuations often rely more on psychological and non-economic factors than traditional financial determinants such as production and demand.

SnbCHF (2015), in their work titled "The Six Major Fundamental Factors that Determine Gold and Silver Prices," reveals that many investors are primarily motivated by considerations outside of economic fundamentals when buying or selling gold and silver. Factors like fluctuating interest rates, public debt, and inflation play pivotal roles. For instance, the decline in gold prices observed during 2013-2014 was attributed to market manipulation and conspiratorial manoeuvres. According to trade experts, gold doesn't serve as a direct income generator, but it offers substantial advantages in capital gains, especially during periods of high inflation. In such times, the returns from gold often outshine those from bonds, dividends, and stocks.

Certain financial experts contend that gold prices indicate the discrepancy between projected U.S. GDP growth and global economic trends. This rings especially true for the UK's national economy, where gold prices significantly correlate with emerging trends influenced by GDP growth and interest rates. Historical data also unveil that gold prices tend to be lower during recession and economic downturns. SnbCHF (2015) identifies major drivers that ignite price fluctuations in gold, revealing patterns tied to the respective ebb and flow of supply and demand for this precious metal. These are described as follows:

- The indirect pricing of manufacturing or production costs of related commodities. This is due to the price fluctuations in the related commodities in parallel with trends in their global demand.

- Inflation rates on national and global levels are sparked as a result of an increase in money supply in markets.

- Dynamics projected through the Balance of Trade and Growth imbalances. The deficit in Trade and Growth largely affects gold prices.

- Financial Activities and related national bank acquisition of gold reserves, including selling and money-printing.

- Interest rates and their difference in employment rates, wages and inflation trends affect gold prices specifically if they lead to patterns of economic downturn.

- The physical demand and supply of the commodity, specifically the aspects like production, manufacturing, stocks and demand.

Gold holds considerable value as a commodity in international and UK markets, specifically in its use as a standard to represent currency value across the globe. Various market conditions and economic aspects define the parameters of supply and demand for gold, giving rise to price fluctuations, as described by Scottsdale Bullion & Coin (2015). These factors are described in detail below:

Global Recession

Global crises and economic trends can often trigger fluctuations in gold prices. These upheavals, stemming from government and market failures, can send gold prices soaring or plummeting. To illustrate, Scottsdale Bullion & Coin (2015) presents the case of the Russian influx into Ukraine, causing financial instability due to uncertain geopolitical conditions and a lack of confidence in the government. This, in turn, led to an increase in gold prices. Gold is typically seen as a reliable asset in turbulent times marked by political or military actions. For instance, during the onset of the first Gulf War, gold prices dipped as investor activity surged, with gold being considered a secure investment and financial refuge.

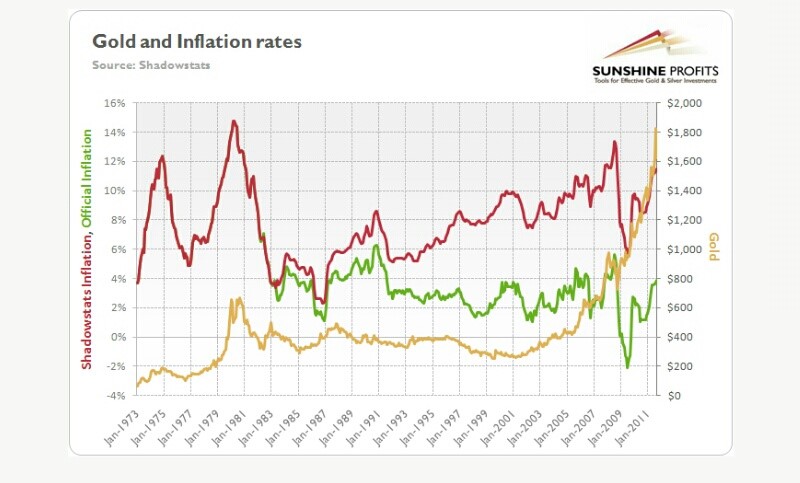

Inflation Rates

Notably, during periods of elevated inflation, gold maintains its stability, acting as a hedge against the diminishing value of paper currency. Demand for gold remains robust, and price fluctuations are relatively muted. Unlike many other commodities, gold is perceived as a secure store of value that can be held for the long term. Consequently, in times of currency devaluation and inflation, gold prices exhibit enduring stability with only minor downward trends. This resilience is largely ascribed to the psychological aspect associated with gold, regarded as a low-risk and substantial investment impervious to the vagaries of political shifts.

Figure 1: Inflation Rates and the Gold Price (Scottsdale Bullion & Coin, 2015).

Currency Value

Gold traditionally serves as a benchmark for currency values, and the U.S. dollar is a primary reserve currency in international trade. According to experts, an inverse relationship exists between the price of gold and the dollar's strength. Gold prices tend to exhibit a notably weaker trend when the dollar's value is high. This dynamic directly impacts sellers and buyers, as a strong dollar drives increased demand for gold, subsequently influencing overall supply trends. This correlation was demonstrated during a period of increased dollar value from September 1 to September 10 2014, as documented by Scottsdale Bullion & Coin (2015), which resulted in a decline in the price of gold.

Production Patterns

According to information provided by Scottsdale Bullion & Coin (2015), the yearly production of gold is approximately 2,500 metric tons, whereas the global supply of gold totals 165,000 metric tons. This data underscores that gold production is relatively modest compared to global supply. Additionally, any increase in production costs is expected to exert upward pressure on gold prices as sellers seek higher prices to maintain profitability.

Physical Supply vs. Demand Dynamics

As previously discussed, the long-term demand for gold remains steady, primarily due to its reputation as a secure store of value and its desirability as valuable jewellery. Its enduring worth results from pricing patterns generally impervious to political considerations. Instead, fluctuations in gold prices are driven by factors such as money supply, production expenses, inflation, interest rates, bank policies, and geopolitical stability. During currency devaluation, low-interest rates, and favourable global economic conditions, investors are further incentivized to purchase gold, leading to an uptick in demand for this precious metal.

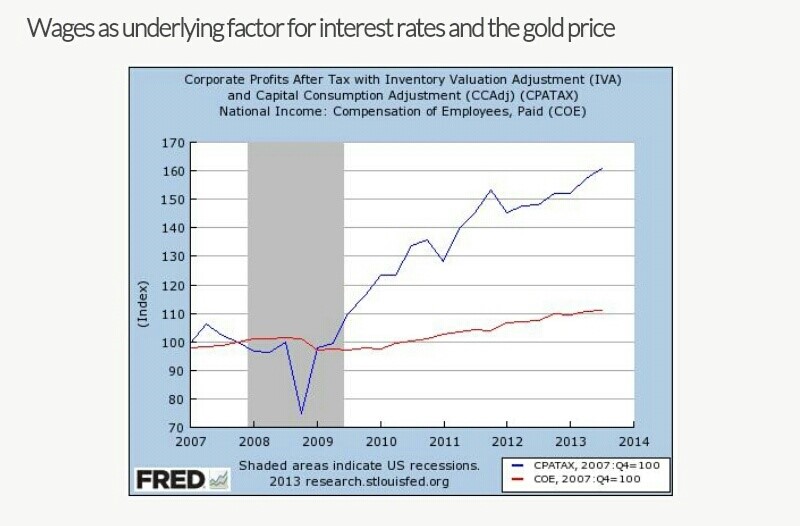

Figure 3: Wages and the Gold Price (Scottsdale Bullion & Coin, 2015).

Question 2- Identify The Negative Externalities That May Arise From The Personal Use of a Car. What Can Governments Do To Try To Influence The Personal Use of Cars So That Private Drivers Accommodate Such Negative Externalities?

An externality is an effect on the third party that stems from an economic decision made by two parties without regard to its influence on the third party. It can be described as a cost borne by the third person due to economic activity or transaction between two people, the producer and the consumer. A negative externality is an external cost that third-party entities like organizations, individuals, resources and estate owners have to bear directly from the transaction between the two concerned parties. As explained by Economics Online (2015), these externalities are also known as spillover effects.

While positive externalities tend to produce desired economic effects regarding pricing and overall benefits to external entities, negative externalities usually produce undesirable effects. An example of a negative externality is the emission of air pollutants from manufacturing industries or automobiles in transportation networks. In the production process, waste generation is typically considered a negative externality as it tends to have pollutant effects on the environment, affecting society and people indirectly. As explained by Economics Online (2015), Externalities are typically generated in scenarios with loopholes in clearly defined assets or resource rights such as ownership rights, etc.

Where resource or land ownership is not certain, such externalities are bound to occur (Mankiw et al., 2011). Similarly, suppose proper legislation or policies concerning the use of these assets are not well-defined, such as in the utility of privately owned vehicles and transportation systems. In that case, such unwanted externalities are risky due to a lack of accountability. This concept has been emphasized by the revered Peruvian Economist Hernando de Soto, as stated by Economics Online (2015), which sheds light on the significance of establishing assets or property rights in economic markets to facilitate sustainability and development of global economies.

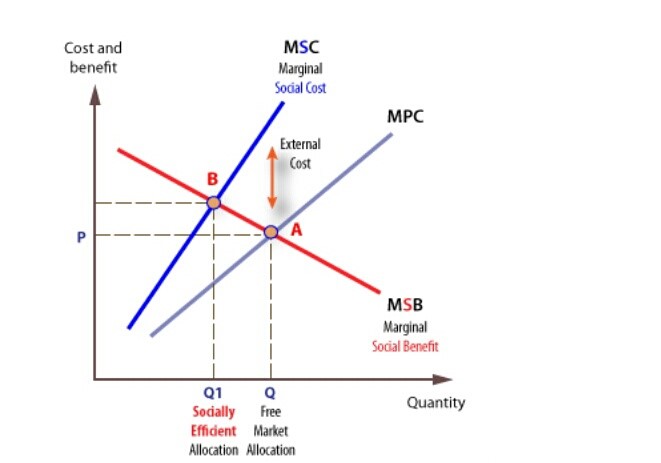

The negative externality can be explained in terms of the marginal social costs, MSC and marginal social benefits, MSB specifically in the scenario of personal car use, for example. An external cost, such as the air pollution caused by emissions of harmful substances in the air by the vehicle, will result in the (MSC) Marginal Social Cost being higher or greater than the MPC or Marginal Private Cost. In terms of socially effective or feasible output, where there is equality in both terms, that is,

MSC = MSB

Figure 4: Marginal Social Costs and Benefits (Economics Online, 2015).

Hence, for this situation, the output is lower at Q compared to the social equilibrium condition described above and represented by Q1. (Economics Online, 2015)

Further, externality, as projected by the Transportation system, is the undesired costs generated due to the manufacturing process. The waste and air pollution also entail risks associated with the health and welfare of society, including people who are directly using vehicles. Taking care of these pollutants and waste also adds up to the administrative costs associated with the cleaning. In such a scenario, the overall cost to society would be more than that of the private cost as complete society cost or benefit is defined as the combined monetary value of total costs and benefits to all entities concerned. This leads to market inefficiencies since the prices of these vehicles or transportation products with externalities would not reflect their transaction's complete social cost or benefit.

In terms of externality related to the transportation system, there has been a keen interest in the social costs incurred as a result of the personal use of the vehicle. The various externalities related to the utility of vehicles is the personal use generated, air pollution, congestion or road traffic, crashes and health risk. The concern with retrospect to these externalities is determining if most of these vehicles are subsidized due to the benefits or environmental effects generated from their use and to what level this influences decisions related to their extended use and increased investment. Are the negative externalities and environmental influence not considered when facilitating the funding of private cars and creating flexible policies for their use? The concern, however, for this study focuses on how these externalities impact society and what the government can do to mitigate the risks associated with these negative externalities.

Researchers have also emphasized the social costs associated with the externalities generated by the private use of cars. The emphasis is on the fact that the legislation and standards related to the use of these vehicles should address the negative externalities relevant to the utility of the car. A deeper study into the transportation system reveals that vehicles are connected to the diverse and rapidly changing road network. The most important entities are automobiles, public transport, highways, traffic regulation systems, and society and government. If these are the prime entities, how about the energy system that drives the automobile network? Does this influence externalities, and should it be part of the transport system analysis when considering and assessing the impact of externalities?

The further analysis raises questions like how much input regarding all related entities that would play a role in the externalities scenario is given to the government's mitigation process or remedial strategies. DeLuchi (1991) in his study stressed the consideration of all such entities in the analysis of externalities and the transportation system life-cycle review. One such externality is the Noise generated by the vehicles on the road. The roads are diverse, open and prime to change, offering a wide platform for numerous vehicles at a time that can lead to noise, particularly due to engines and horns. This can cause considerable societal costs regarding discomfort, environmental pollution related to noise and nuisance to people. If the relation is high, the direct impact can be analyzed by correlating the cause (transportation or vehicle) and effect ( externality or noise). Further noise generated by traffic flow can cause property values to decline, especially if they are located on the roadside.

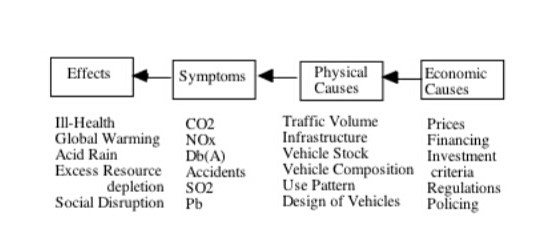

Figure 5: Social Costs - Causes and Effects (extracted/processed by the author).

A significant externality is the emission of air pollutants like carbon monoxide and other substances due to fuel burning or vehicle combustion. The societal costs of the environmental impact are larger than the private costs of vehicle production. The emission of air pollutants like carbon monoxide, nitrogen oxide and hydrocarbons tends to affect the environment by posing threats like smog, acid rain and ozone depletion. There are further issues like material and vegetation effects. Hence, this externality also needs to be addressed. The consideration here is private costs vs. social costs. The private costs would not consider the costs associated with the environmental impact on society.

The exact reason for the difference in these costs and their assessment is to mitigate economic agents that are key in incurring costs on other market entities. When an individual will only consider the costs they will incur for a decision without regard to the costs incurred by other parties, then the externality will not allocate resources appropriately as the economic agents will not address the costs imposed by them. Strategies to address externalities should focus on fixing these economic agents' activities that result in improper resource allocation.

Another externality caused by the private use of cars is congestion that leads to traffic and road blockage. The costs associated with society due to traffic and congestion include the value of time and quality of the trip. The value and cost associated with business trips are relatively more than those related to personal trips. Lastly, the externality of crashes and accidents has high societal costs regarding risks related to the health of drivers, pedestrians, and other drivers. The two aspects to be considered when estimating the costs related to crashes are the value of life and the costs related to damages. The damages cost includes direct costs and the value of the years lost to the crash. A comprehensive cost assessment must be done to analyze the effects of this externality and the societal costs in totality.

What measures can the government then take to encourage the use of personal cars and mitigate the risks and social costs associated with the negative externalities? Button (1994) has proposed a model that considers all related aspects and economic causes that spark externalities. Policymakers and government entities should consider the complete impact of the costs incurred by the environmental effects and other externalities and, based on the analysis, devise remedial standards and pricing strategies. When estimating costs related to the impact of externalities for using private cars like congestion, pollution, noise and crash costs, all estimates should be considered, like the value of health, time, safety, life and trip.

The prime solution is to define the property or ownership rights clearly so that externalities are limited due to the element of accountability. The Government should establish regulations, taxation and proper policies to minimize the risk of these externalities. Private car owners who are polluters should be taxed or penalized, and standards should be set for the optimal level of hydrocarbons and other pollutant emissions. Using filters and gadgets in vehicles to minimize pollution should be ensured. Similarly, laws for noise through horns and engine maintenance should be established to minimize social costs associated with this externality.

Subsidies should be given to vehicle owners that ensure proper maintenance and antipollution practices when driving. Laws should be enforced to ensure that owners of vehicles pay compensation to those affected by externalities like noise, crashes or pollution. Increasing awareness regarding the externalities on the society of vehicle owners with information on acceptable emissions levels, noise generation and safe driving compliance with traffic laws. The government can minimize society's costs relative to the negative externalities by implementing regulations and pricing strategies.

Reference List

Button, Kenneth., 1994. Alternative Approaches toward Containing Transport Externalities: An International Comparison Transportation Research. A Vol. 28A No. 4 PP. 289-305.

Fiscal and monetary policy tools, HM-Treasury, 2015. Available at: <http://www.hm-treasury.gov.uk/>. Accessed [23 December 2015]

How These 10 Factors Regularly Influence Gold Prices, Scottsdale Bullion & Coin, 2015. Available online at:<http://www.sbcgold.com/blog/10-factors-regularly-influence-gold-prices/. Accessed [23 December 2015]

International economic information and policy, International Monetary Fund, 2015. Available at: <http://www.imf.org/>. Accessed [23 December 2015]

Jones-Lee, Michael., 1990, The Value of Transport Safety, Oxford Review of Economic Policy, Vol. 6, No. 2, Summer 1990 pp. 39-60.

Macroeconomic Information, Bank of England, 2015. Available at: <http://www.bankofengland.co.uk/>. Accessed [23 December 2015]

Mankiw, N., Taylor, M. & Ashwin, A., (2011). Business Economics 2nd Edition. Cengage Learning.

Miller, Ted. (1992). The Costs of Highway Crashes, Federal Highway Administration (FHWA-RD-91-055).

Negative Externalities, Economics Online, 2015. Available at:<

http://www.economicsonline.co.uk/Market_failures/Externalities.html/. Accessed [29 December 2015]

Parkin, Powell, & Matthews, (2015), Economics 9th Edition.

Pearson, G.A., and Wall, S., (2011), Economics for Business and Management 3rd Edition. FT/Prentice Hall.

Supply and Demand, University of Rhode Island, 2015. Available at:<https://www.google.com.pk/url?sa=t&source=web&rct=j&url=http://www.uri.edu/artsci/ecn/mead/INT1/ECN202/Read/Eco_S-D.pdf/>. Accessed [26 December 2015]

The Six Major Fundamental Factors that Determine Gold and Silver Prices, SnbCHF.com, 2015. Available at :<

http://snbchf.com/gold/gold-and-silver-prices/>. Accessed [27 December 2015]

Using Supply and Demand, MHeducation.com, 2015. Available at :<

https://www.google.com.pk/url?sa=t&source=web&rct=j&url=http://highered.mheducation.com/sites/dl/free/0070901104/59726/colander_sample_ch05.pdf/. Accessed [23 December 2015]

Get 3+ Free Dissertation Topics within 24 hours?